Treasury Yields Surge After Weak Auction: What It Means for Investors

Treasury yields surged on Tuesday following a disappointing auction of 30-year bonds, sending ripples through the financial markets. This unexpected jump raises concerns about the future trajectory of interest rates and the overall health of the economy. Let's delve into the details and explore the implications for investors.

Weak Auction Sparks Yield Increase

The auction of $21 billion in 30-year Treasury bonds saw weaker-than-expected demand. This indicates that investors are less eager to purchase long-term government debt, a signal that could point towards several factors, including:

- Inflation Concerns: Persistently high inflation remains a significant concern. Investors may be anticipating further interest rate hikes by the Federal Reserve, reducing the attractiveness of lower-yielding bonds.

- Economic Uncertainty: Global economic uncertainty, including potential recessionary pressures, is also likely playing a role. Investors might be shifting their portfolios towards assets perceived as safer havens in times of economic turmoil.

- Increased Risk Appetite: Conversely, some analysts suggest the weak auction may reflect increased investor appetite for riskier assets, potentially signaling a shift away from the perceived safety of government bonds.

The disappointing demand led to a higher yield on the 30-year bonds, impacting the broader Treasury market. This increased yield then cascaded throughout the yield curve, affecting yields on shorter-term securities as well.

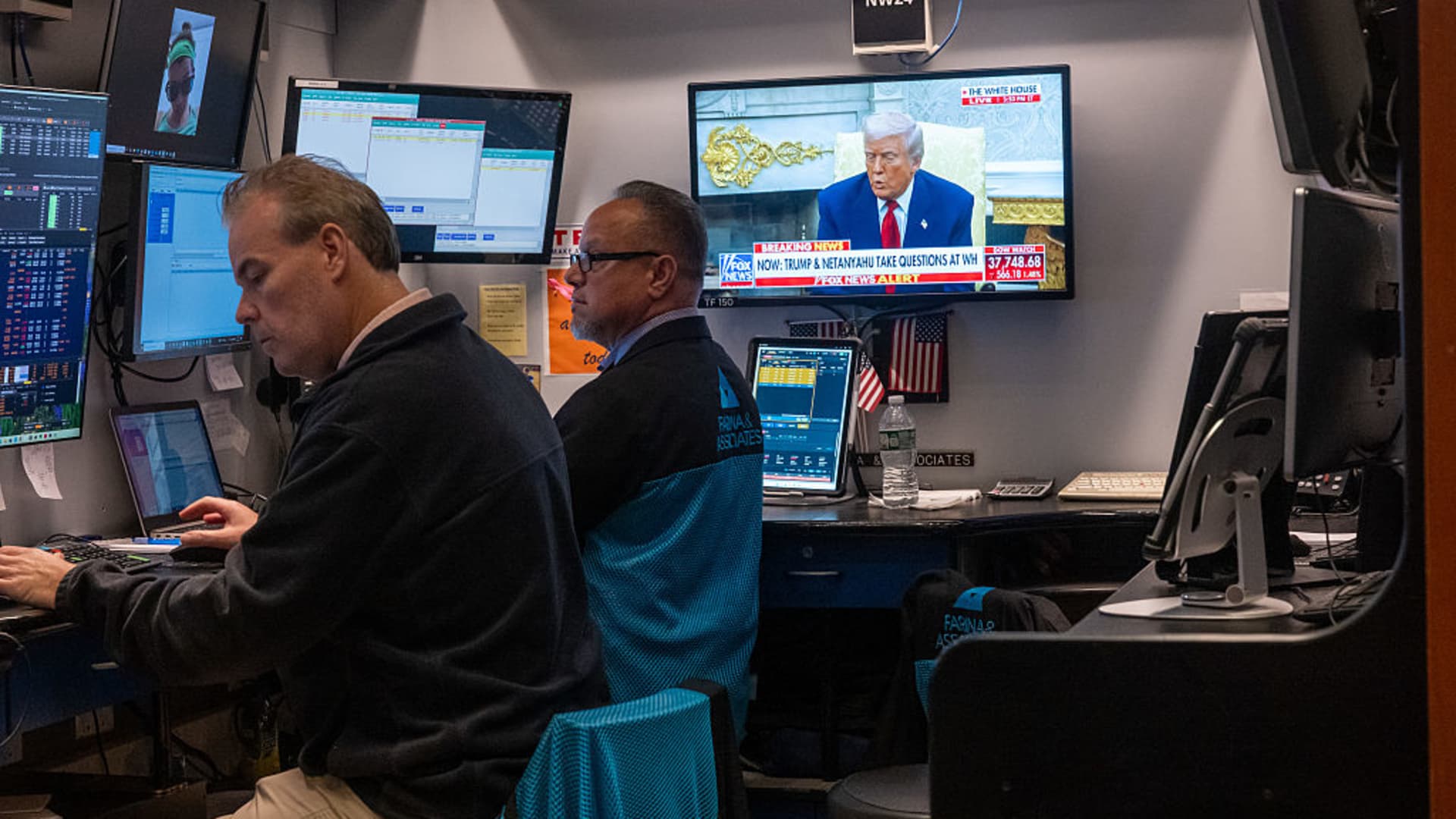

Impact on the Broader Market

The surge in Treasury yields has several potential implications for various sectors:

- Mortgage Rates: Higher Treasury yields often translate to higher mortgage rates, potentially cooling down the already slowing housing market. This could impact both homebuyers and the construction industry.

- Corporate Bonds: The increased yields on government bonds can also influence corporate bond yields, potentially increasing borrowing costs for businesses. This could lead to reduced investment and slower economic growth.

- Stock Market: While the immediate impact on the stock market is complex and depends on various factors, rising yields can generally put downward pressure on stock valuations, particularly for growth stocks which are more sensitive to interest rate changes.

What Investors Should Do

The weak auction and subsequent yield surge underscore the importance of diversification and strategic asset allocation. Investors should consider:

- Diversifying Portfolio: Spreading investments across different asset classes, including stocks, bonds, and real estate, can help mitigate risks associated with market fluctuations.

- Re-evaluating Risk Tolerance: Given the current economic uncertainty, investors may want to re-evaluate their risk tolerance and adjust their portfolios accordingly. This might involve shifting towards more conservative investments.

- Seeking Professional Advice: Consulting with a financial advisor can provide personalized guidance based on individual circumstances and investment goals.

Conclusion: Navigating Uncertainty

The weak Treasury auction and the resulting surge in yields highlight the ongoing challenges facing the financial markets. While the immediate future remains uncertain, understanding the underlying factors driving these changes is crucial for making informed investment decisions. Staying informed about economic indicators and market trends is paramount for navigating this period of volatility. Remember to consult with a financial professional for personalized advice tailored to your specific situation.

Keywords: Treasury yields, bond auction, 30-year bonds, interest rates, inflation, economic uncertainty, mortgage rates, stock market, investment strategy, financial advice, market volatility.